6.2 Akerlof (1970)

This assignment explores George Akerlof’s seminal 1970 paper “The Market for Lemons,” which demonstrates how asymmetric information leads to market failure in a toy example about low quality used cars (“lemons”). The paper shows that when sellers have more information about product quality than buyers, lower-quality goods can drive higher-quality goods out of the market, potentially causing the market to collapse entirely.

Question 1: Utility Maximization for Perfect Substitutes

You’re making cookies and need to purchase either butter or margarine with $12. If butter costs $3 per pound and margarine costs $4 per pound, and you consider them perfect substitutes, what will you purchase and how much?

What if the prices were reversed: butter costs $4 per pound and margarine costs $3 per pound. What will you choose and how much can you buy?

We can analyze these questions using budget constraints and indifference curves:

- Utility function for perfect substitutes: \(U(x_b, x_m) = x_b + x_m\)

- Budget constraint: \(p_b x_b + p_m x_m \leq 12\)

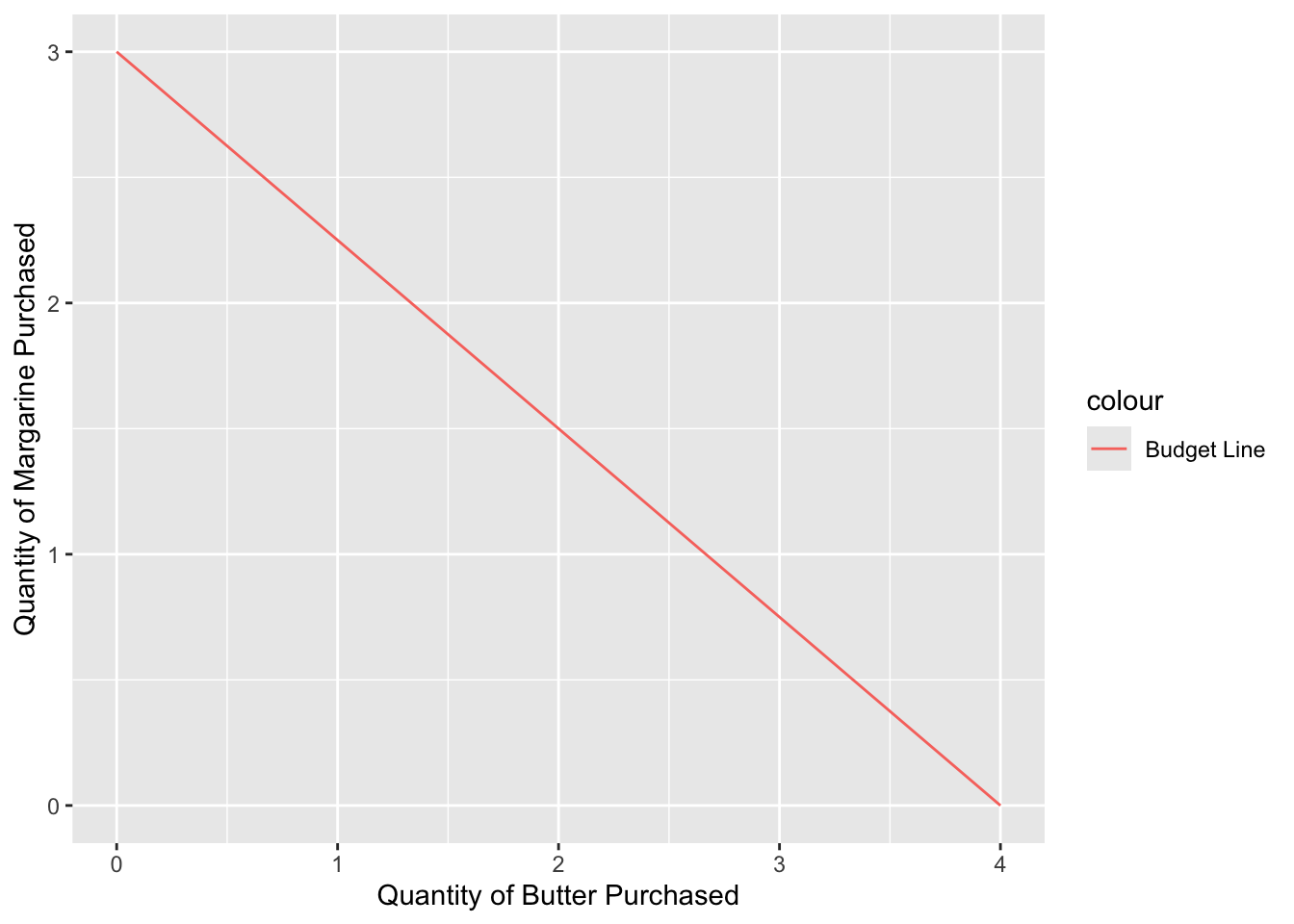

If butter costs $3 and margarine costs $4, the budget line is:

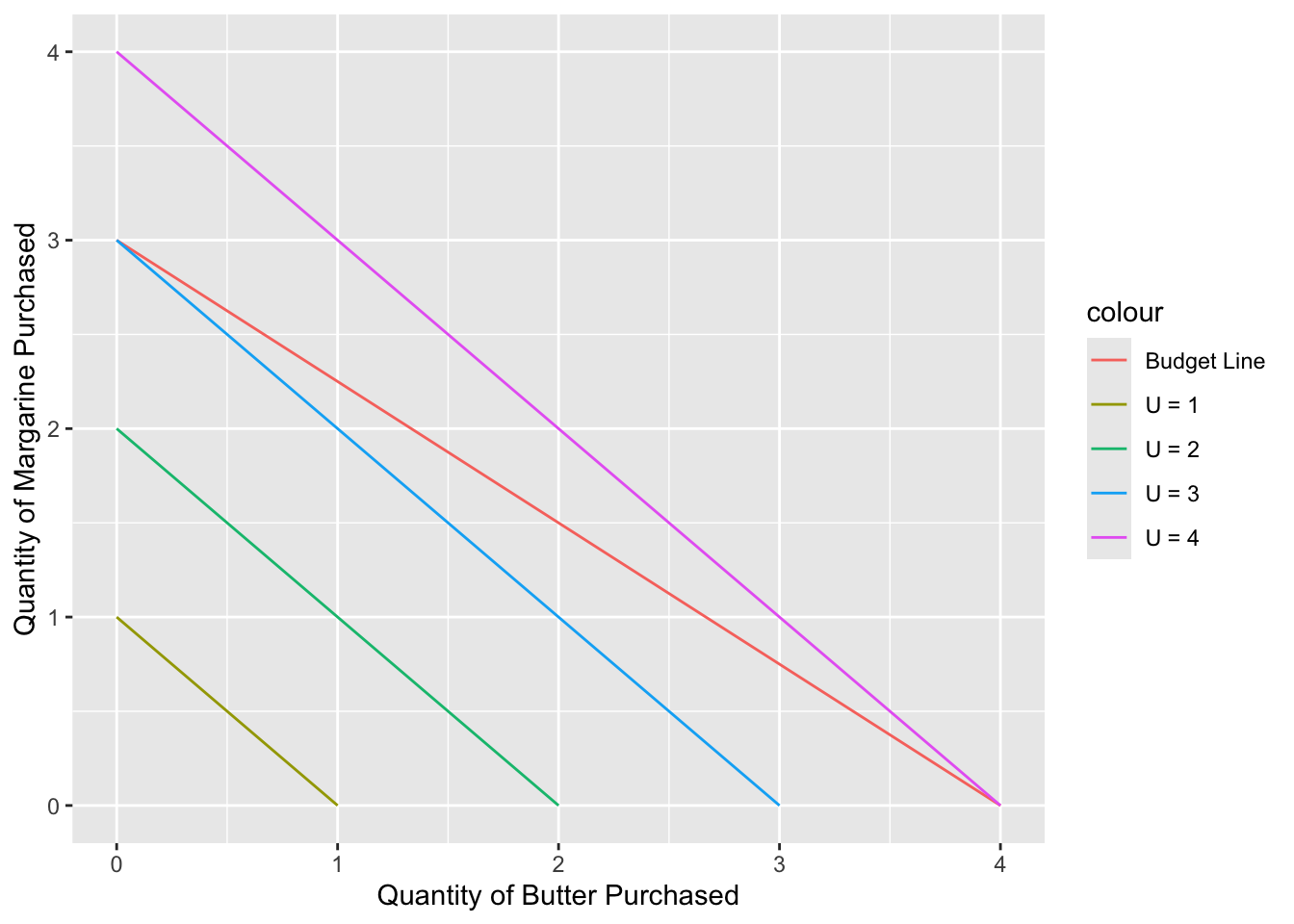

Adding several indifference curves (higher utility to the Northeast):

Looking at the plot above, what is the highest indifference curve you can reach while staying on the red budget line? What is the highest utility achievable and how much butter and margarine are bought?

When utility is Cobb-Douglas, we can use the point of tangency to find the bundle that generates the highest utility. Does that method work here with perfect substitutes? Why or why not?

The Market for Lemons: Asymmetric Information and Market Failure

Akerlof’s model demonstrates how asymmetric information can lead to market failure:

- The model is illustrative rather than strictly realistic

- When sellers have more information about product quality than buyers, this information asymmetry distorts the market

- At any given price, the quality of cars people are willing to sell is never high enough on average to make buyers willing to purchase

- The mere willingness to sell signals that the quality isn’t worth the price

Consider a market with cars distributed uniformly between quality \(0 < \mu < 2\).

Type 1 Consumers

Suppose there are type 1 consumers with the utility function \(U_1 = M + \sum_{i = 1}^N x_i\) where:

- \(N\): number of cars the consumer has

- \(x_i\): quality of those cars

- \(M\): money spent on all other things

For type 1 consumers, cars and other goods are perfect substitutes. Let type 1 consumers have an income of \(Y_1\).

Question 2: Demand for Used Cars under Asymmetric Information

The critical feature of this market is asymmetric information: sellers know the exact quality of their cars \(x_i\), while buyers know only the average quality \(\mu\) of cars in the market.

If the average quality of used cars is \(\mu = 0\), how much does a type 1 consumer expect to add to their utility by buying a car at price \(p > 0\)? Will they buy cars or spend money elsewhere?

If the average quality of cars were \(\mu = 1\), for what prices will the consumer spend all their money on cars instead of other things?

What does \(\frac{\mu}{p}\) need to be for the type 1 consumer to demand \(Y_1/p\) cars instead of other things?

Consider type 2 consumers. They have the utility function \(U_2 = M + \sum_{i = 1}^N \frac{3}{2} x_i\). If \(\mu = 1\), for what prices will these consumers spend all their money on cars instead of other things?

What does \(\frac{\mu}{p}\) need to be for the type 2 consumer to demand \(Y_2/p\) cars instead of other things?

Question 3: Supply of Used Cars

Now suppose type 1 consumers have a total of 100 cars they might be willing to sell and type 2 consumers have 0 cars, and they might be willing to buy.

The quality of the 100 cars \(x_i\) is distributed uniformly between 0 and 2:

seq(0, 2, length.out = 100) %>% round(digits = 2) [1] 0.00 0.02 0.04 0.06 0.08 0.10 0.12 0.14 0.16 0.18 0.20 0.22 0.24 0.26 0.28

[16] 0.30 0.32 0.34 0.36 0.38 0.40 0.42 0.44 0.46 0.48 0.51 0.53 0.55 0.57 0.59

[31] 0.61 0.63 0.65 0.67 0.69 0.71 0.73 0.75 0.77 0.79 0.81 0.83 0.85 0.87 0.89

[46] 0.91 0.93 0.95 0.97 0.99 1.01 1.03 1.05 1.07 1.09 1.11 1.13 1.15 1.17 1.19

[61] 1.21 1.23 1.25 1.27 1.29 1.31 1.33 1.35 1.37 1.39 1.41 1.43 1.45 1.47 1.49

[76] 1.52 1.54 1.56 1.58 1.60 1.62 1.64 1.66 1.68 1.70 1.72 1.74 1.76 1.78 1.80

[91] 1.82 1.84 1.86 1.88 1.90 1.92 1.94 1.96 1.98 2.00At a price of \(p > 2\), how many cars out of the 100 total would the type 1 consumers be willing to sell? For each car sold, they add to their utility by \(p\) (via \(M\)), but subtract from their utility by the quality of the car sold \(x_i\). What is the average quality \(\mu\) of the cars supplied?

At a price of \(p = 1\), how many cars would type 1 consumers sell? What is the average quality \(\mu\) of cars supplied?

Supply for used cars is given by \(Q_S = 50p\) for prices between 0 and 2. Find an equation for the average quality of cars supplied as a function of p: \(\mu = \_\_\_\). If the price of used cars is low, will the average quality be high or low?

Question 4: Equilibrium in the Market for Lemons

From Question 3c, the average quality of used cars that type 1 consumers are willing to sell is \(\mu = \_\_\_\). From Question 2e, type 2 consumers will only buy used cars if the average quality \(\mu\) is greater than ___.

Explain why no used cars will be sold in this example, emphasizing the role of asymmetric information in creating market failure.

More Applications

Insurance Markets

Medicare was established in 1965 to address a serious market failure in health insurance. Before Medicare, older adults often couldn’t purchase medical insurance due to adverse selection—a direct result of asymmetric information. As insurance companies raised prices for the elderly, healthier seniors dropped out, leaving only those expecting high medical costs in the pool. This created a spiral: higher premiums led to increasingly sicker pools of insured individuals, making insurance ultimately unsustainable.

This mirrors the “lemons” problem exactly: as prices rise, only those with inside information about their poor health remained in the market. Group insurance through employers works because it pools risk across both healthy and unhealthy individuals, but this left retirees and others without employer coverage vulnerable.

Medicare solved this market failure by providing guaranteed coverage for seniors, preventing the adverse selection problem. Today, it covers over 65 million Americans, including seniors and younger people with disabilities, ensuring access to care for high-risk populations who would otherwise be excluded from private insurance markets.

Question 5: Credit Markets in Low-Income Countries

Credit markets in low-income countries demonstrate classic market failure due to severe asymmetric information.

Who knows more about a certain borrower’s risk of defaulting on a loan? The borrower themselves, or the lenders?

The default rate tends to be high in these countries, so why doesn’t the rate of interest on loans rise to meet that risk of default?