4.6 Tariffs and Protectionism

Introduction

International trade has evolved dramatically over the past century, profoundly impacting global economies. Before World War I, trade was expanding rapidly, and cross-border travel was often passport-free. However, both world wars along with the Great Depression led to rising tariffs, quotas, and stricter travel controls, which stifled global trade.

After World War II, leaders sought to rebuild the global economy by reducing trade barriers. This effort resulted in the General Agreement on Tariffs and Trade (GATT) in 1947, which aimed to promote trade and peaceful cooperation. By the 21st century, average tariffs in many countries had fallen below 5%, supported by institutions like the World Trade Organization (WTO), enabling unprecedented global trade growth.

The expansion of trade has transformed developing nations, particularly China, where manufacturing exports lifted hundreds of millions of people out of poverty. However, globalization has also created challenges, such as the decline of low- to medium-skilled jobs in developed economies like the U.S., due to outsourcing and automation.

Recent years have seen renewed trade tensions. In 2018, President Trump imposed major tariffs on Chinese imports, sparking a trade war as China retaliated with its own tariffs. In his new term, President Trump has set a blanket 20% tariff on all Chinese imports, along with a 25% tariff on imports from Canada and Mexico, stunning the world. To compare, under Obama, tariffs on Chinese imports were on average just 3%, and imports from Canada and Mexico were nearly 0% due to NAFTA (North American Free Trade Agreement).

This assignment will set the stage for analyzing trade policies, including tariffs and protectionism, using supply and demand principles. It also explores who benefits and who loses from trade, as well as the political and economic consequences of trade decisions in an interconnected world.

Analyzing Tariffs using Supply and Demand

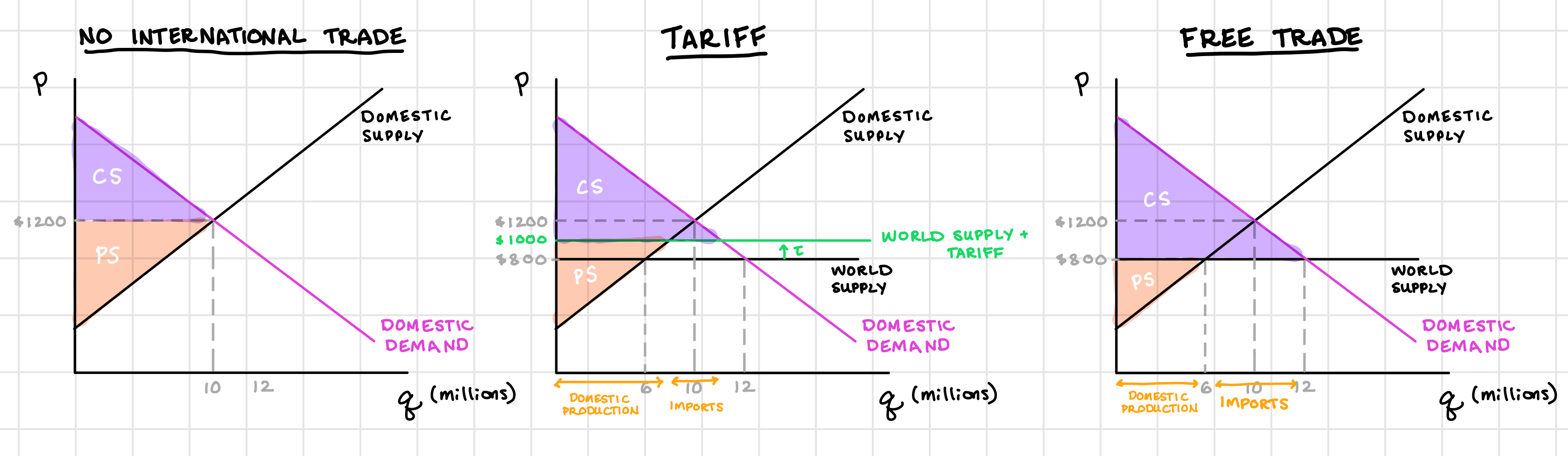

No World Trade vs Free Trade

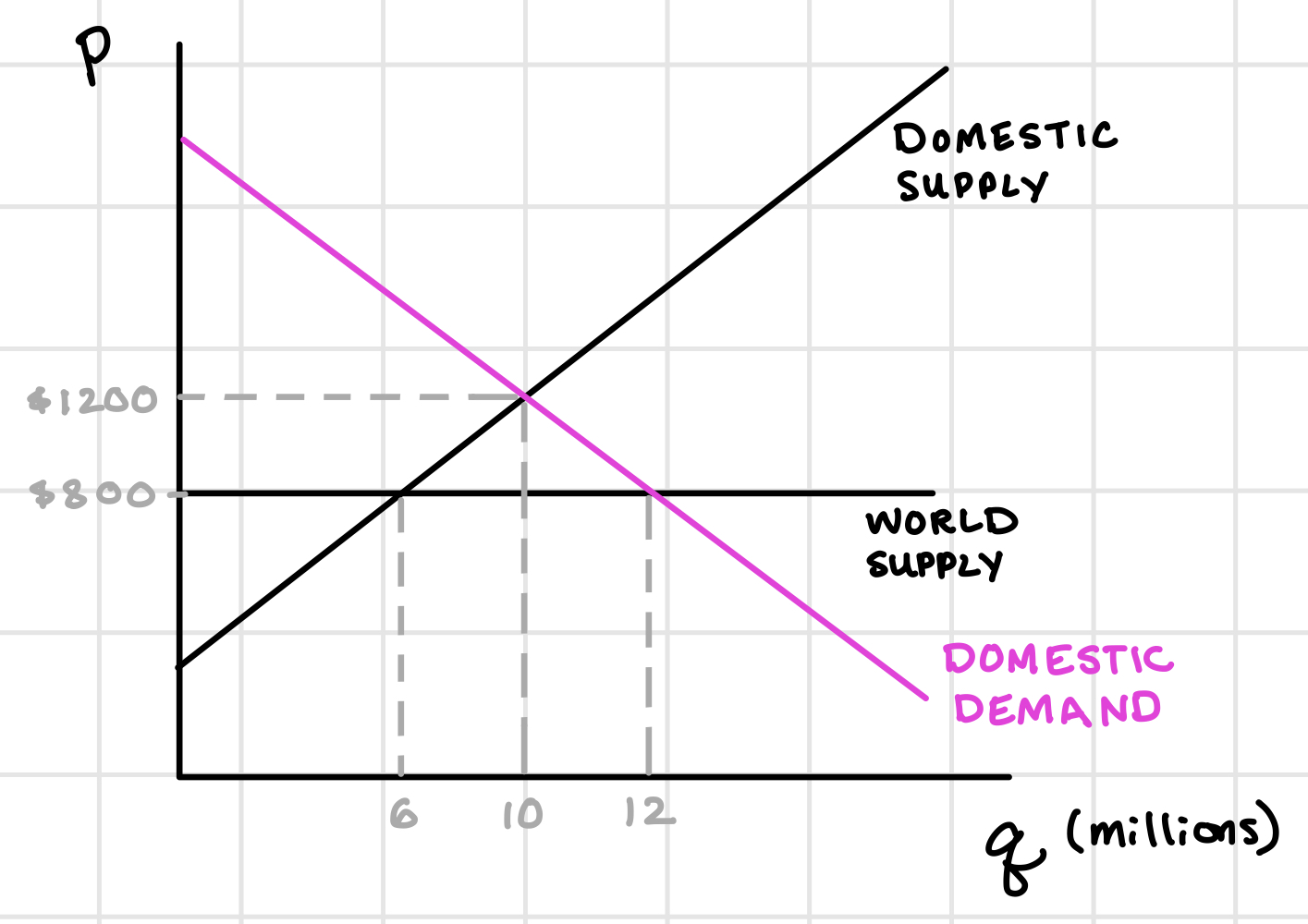

Consider the market for washing machines. I’ll break down the supply for washing machines into two pieces: domestic supply and world supply.

- Domestic Supply: This curve slopes upward, meaning that as the price of washing machines increases, U.S. suppliers are willing to produce more.

- World Supply: This curve is perfectly elastic at the world price. This happens because the U.S. demand for washing machines is relatively small compared to global demand. As a result, U.S. buyers can purchase as many washing machines as they want at the world price without causing the price to rise. In other words, the world market can meet U.S. demand at a constant price, regardless of how much the U.S. buys.

Now I’ll add the domestic demand for washing machines.

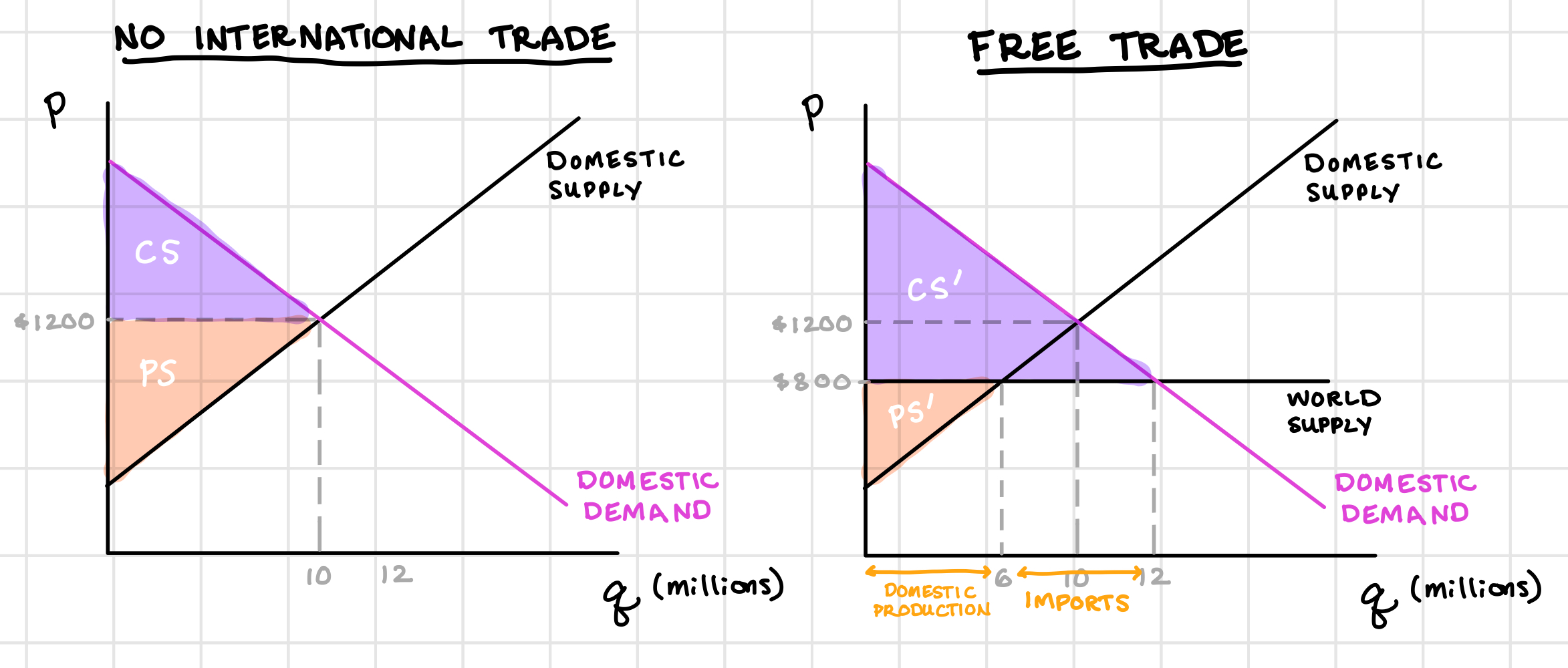

- If no international trade were allowed to happen, the equilibrium would be where domestic supply intersects domestic demand. There, the price of washing machines would be ___ and there would be ___ million washing machines bought and sold in the US.

Answers:

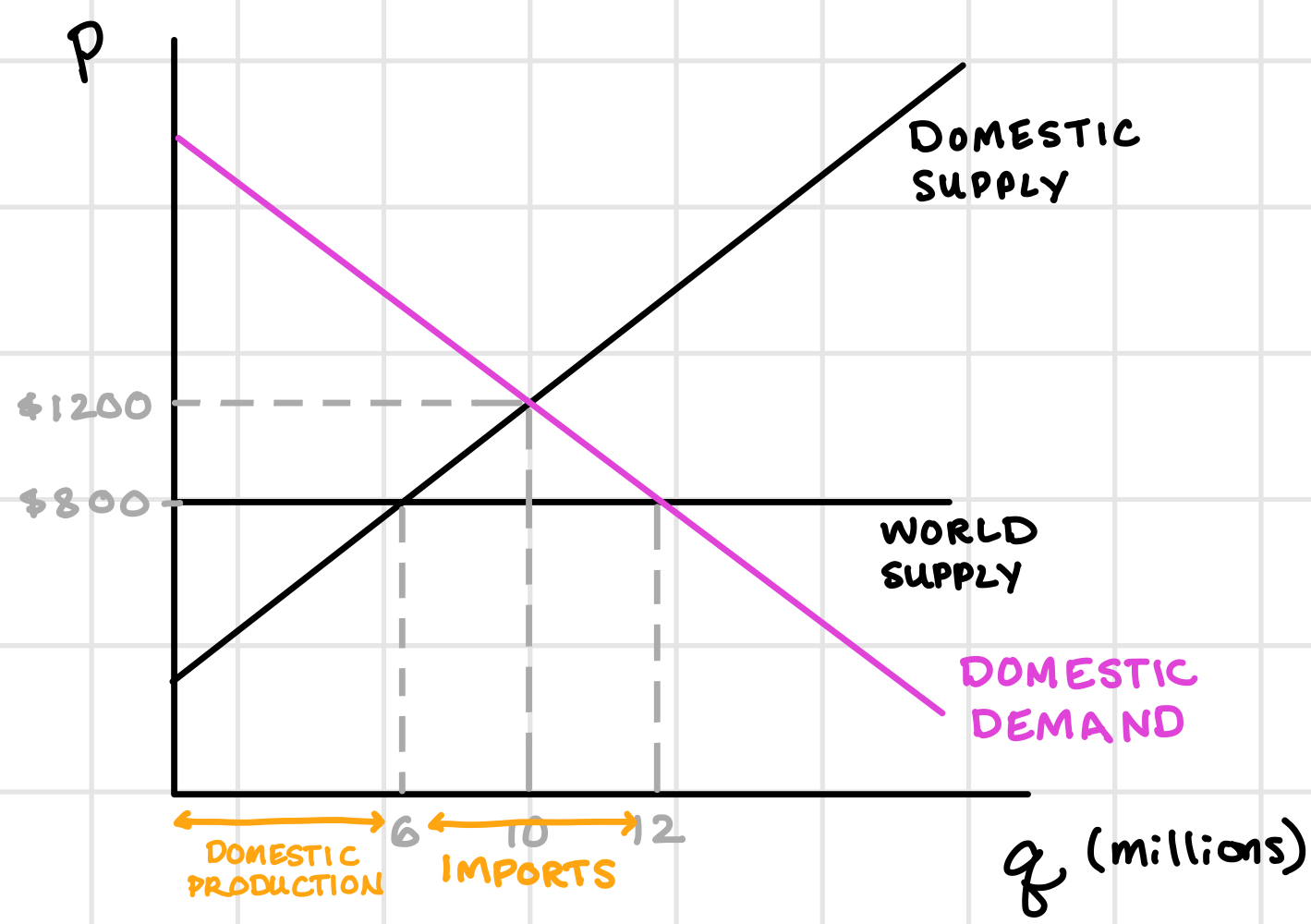

- Under free trade on the other hand, the equilibrium would be where domestic demand intersects the world supply. In this case, the price of washing machines would be ___ and there would be ___ million washing machines bought and sold in the US. Notice that the lowest cost domestic suppliers would still be able to sell washing machines. That is, if you are a supplier willing to sell washing machines at prices below or equal to the world price, you will still be able to sell washing machines under free trade, receiving the world price for them. So domestic production is where the domestic supply curve intersects the world supply curve: ___ million washing machines are produced domestically. Imports make up the difference between domestic supply and domestic demand: ___ million washing machines are imported.

Answers:

- Interpret your answers by filling in the blanks: When the world price is lower than the price under no international trade, lifting trade restrictions will (harm/benefit) domestic consumers by (lowering/raising) the price of the good, and (less/more) domestic consumers will be able to purchase the good. (Low/high) cost domestic producers will still be able to supply to the market, while (low/high) cost domestic producers will be competed away.

Answers:

Notice that when trade restrictions are lifted, consumer surplus increases by more than producer surplus falls. That is, free trade means more total surplus.

Tariffs

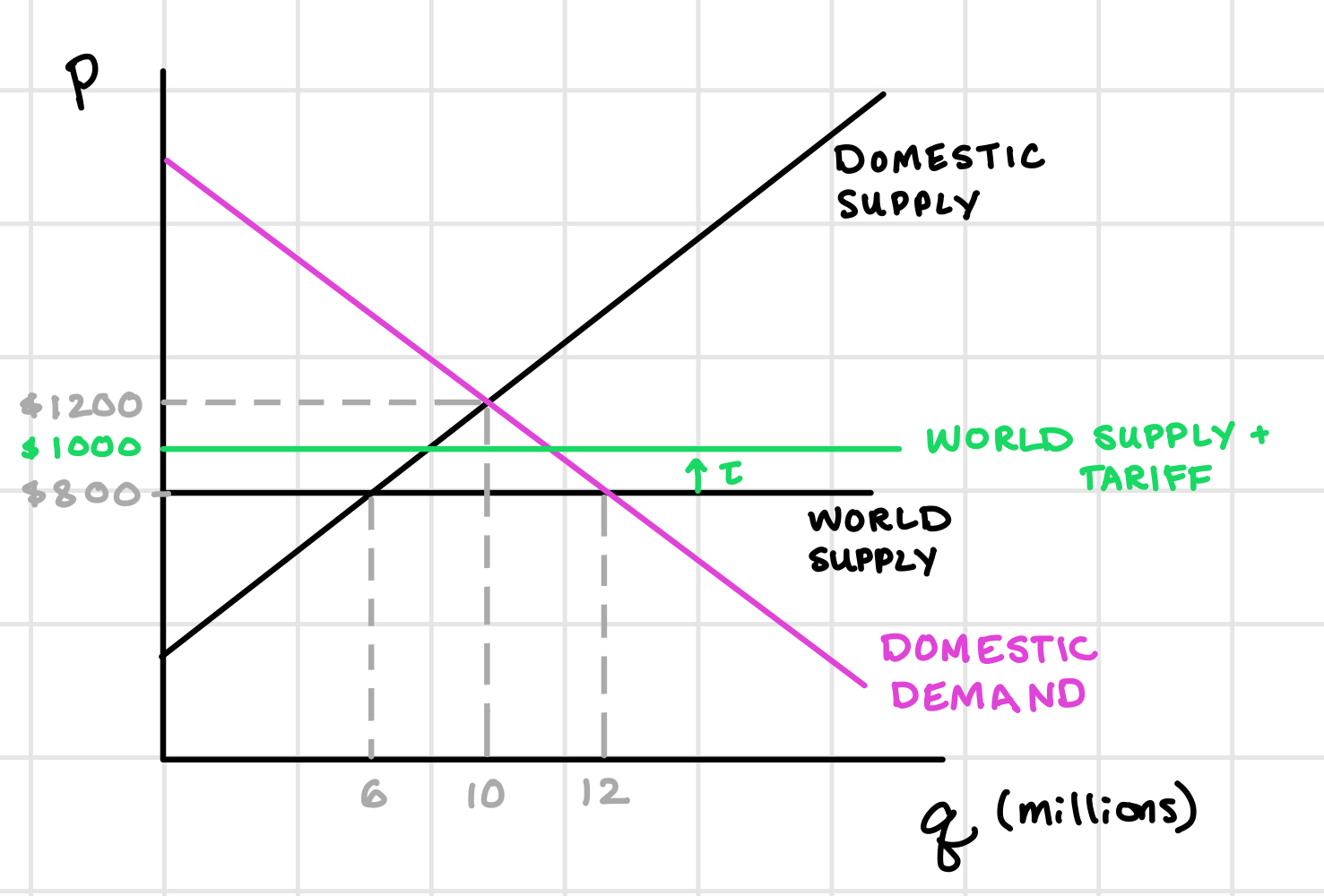

Many countries restrict imports using tariffs: this is called protectionism. A tariff is a tax on imports.

We can represent a tariff on our graph by shifting the world price up by the size of the tariff. For example, a $200 per unit tariff on washing machine imports would look like this:

- Under the tariff, you can find the equilibrium price and quantity by the intersection of the demand curve and the world supply plus the tariff. There, the price for a washing machine is ___ and there are about ___ million sold. ___ units are produced domestically and ___ units are imported.

Answers:

- Interpret your answers by filling in the blanks: Consumers see the lowest prices under free trade, or (very low/very high) tariffs. Domestic producers are able to sell for the highest prices under no international trade, or (very low/very high) tariffs. As tariffs increase, imports (increase/decrease).

Answers:

Consider the American Automotive industry. In 2023, the U.S. produced 10.6 million motor vehicles, and exported 1.65 million cars to other countries (mostly to Canada). Canada and Mexico produce more than half of the individual car parts that American automakers import every year. President Trump has just put a blanket tariff of 25% on imported goods from Canada and Mexico. Canada has responded by announcing it will apply a 25% tariff on US imports. Mexico is also threatening to retaliate in a similar way.

- The U.S. tariffs on imports will (help/hurt) domestic car producers by raising the price of cars here in the U.S.

Answer:

- But the U.S. tariffs on imports from Canada and Mexico will (help/hurt) domestic car producers because they are the buyers of car parts from Canada and Mexico, so producing cars in the U.S. will become more expensive.

Answer:

- And because Canada has applied a retaliatory 25% tariff on U.S. imports, U.S. companies will see much (more/less) demand for cars coming from Canadian consumers.

Answer:

- Consumers in the U.S. also (win/lose) in more ways than one: car prices will certainly (increase/decrease), as will the price of any other product that is imported from Canada or Mexico (or China, for which we’ve also raised tariffs).

Answer: